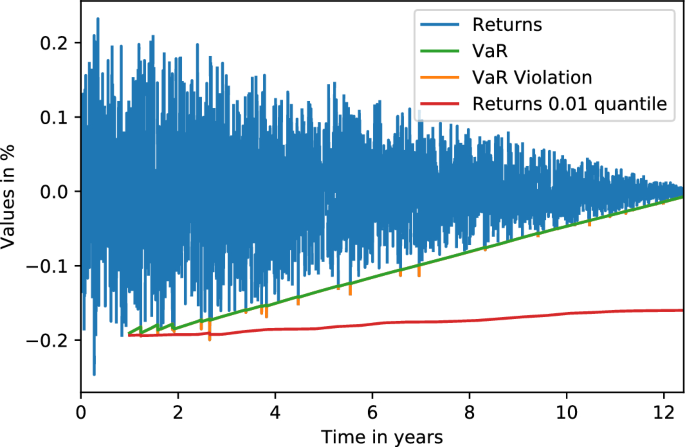

Averaged cross price impact effect vs. pull to par effect over 10.000... | Download Scientific Diagram

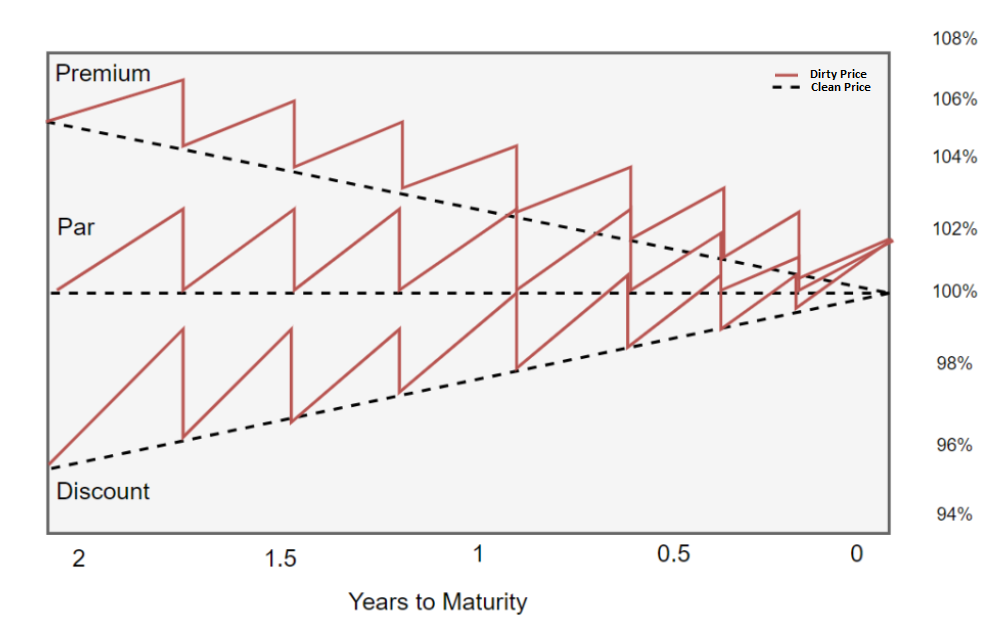

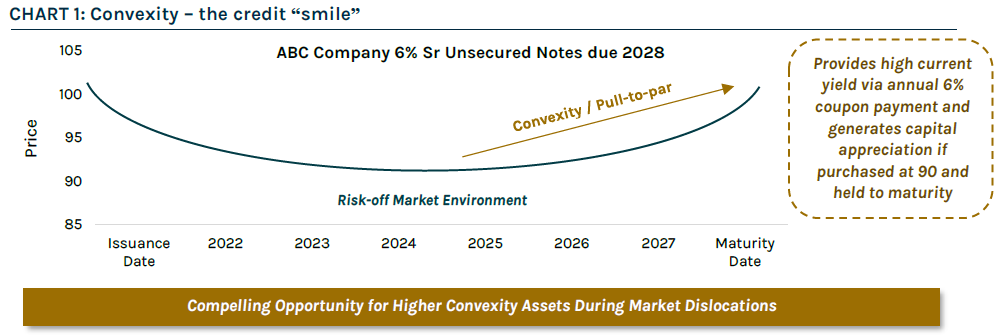

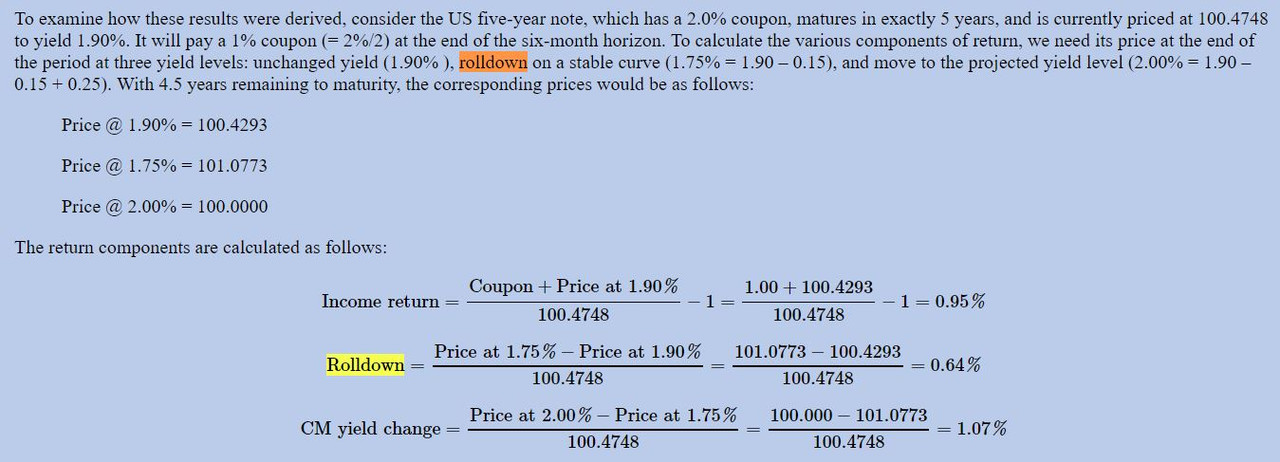

fixed income - What is the difference between pull to par and roll down in both mathematics and conceptual? - Quantitative Finance Stack Exchange

Averaged cross price impact effect vs. pull to par effect over 10.000... | Download Scientific Diagram

Averaged cross price impact effect vs. pull to par effect over 10.000... | Download Scientific Diagram

:max_bytes(150000):strip_icc()/dotdash_Final_Par_Yield_Curve_Apr_2020-01-3d27bef7ca0c4320ae2a5699fb798f47.jpg)